懒得管了,有人倒卖我的软件,我让他停止倒卖还开始骂人,我技术也不高,加个登录只是为了引流罢了就这还有人破解。我的软件也不保证每个地方都能用,最近忙,不能及时更新,抱歉。感谢大家的支持,本博客将遵循永久免费的宗旨,大家要提高警惕防止被骗。

前言

我之前写的一个小软件深受大家的喜爱,然后呢,好多人反映某些地区用不了,于是我以技术研究交流为目的,来重新写一份软件更新版,可能个别地区会不一样,自行测试。

警告

千万不要用于非法用途,仅供技术交流与漏洞检测,如若使用,造成的任何法律责任,后果自负。

话不多说,直接上图

请不要垃圾评论,否则封账号

这是我2021年4月13日测试过的,完全没问题,大家自行测试。

右下角为灰色时代表破解成功,等待破解完成之后去挂机,如果挂机失败代表破解成功!

2021-5-3所出现问题更新

一定要仔细看这些文字,根据反馈,我了解到以下几个问题。

1.电脑任务栏及桌面消失的情况

请大家手动操作,启动任务管理器—左上角文件—运行新任务—输入“explorer.exe”就行

2.图标不变灰,并且过一段时间自动重启

这种情况是非常难搞的,根据地区不同所使用的防逃费程序也不同,所以有能力的人,自己去任务管理器查找可疑的进程,结束进程或者挂起进程,去看这个进程被改变之后电脑所出现的反应,来判断哪个是防逃费的程序,来杀掉进程或者挂起进程。就可以解决这个问题。

3.关于前台的显示情况

有人问我,前台是否会显示异常非法登录,这种情况基本上出现的几率不大,一般情况下都是显示关机状态的,除非网吧老板重金定制防逃费,所以大家一定要猥琐,在使用软件时在没有摄像头和他人观看时使用;当网吧人数几乎达到满员状态时就不要在使用了,下次再来。

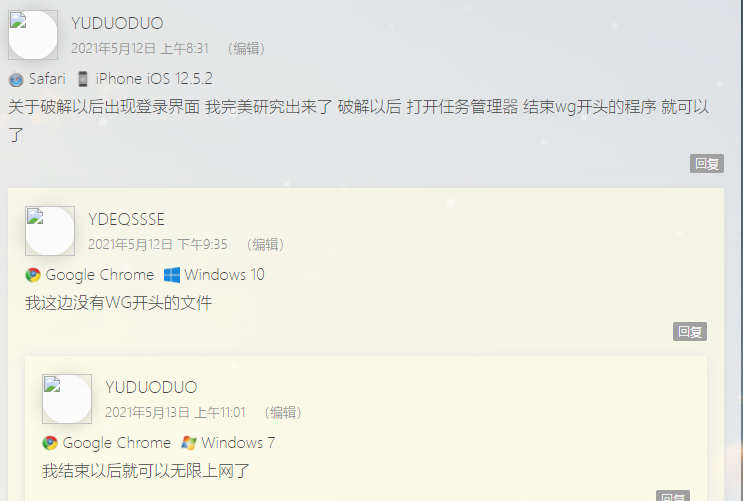

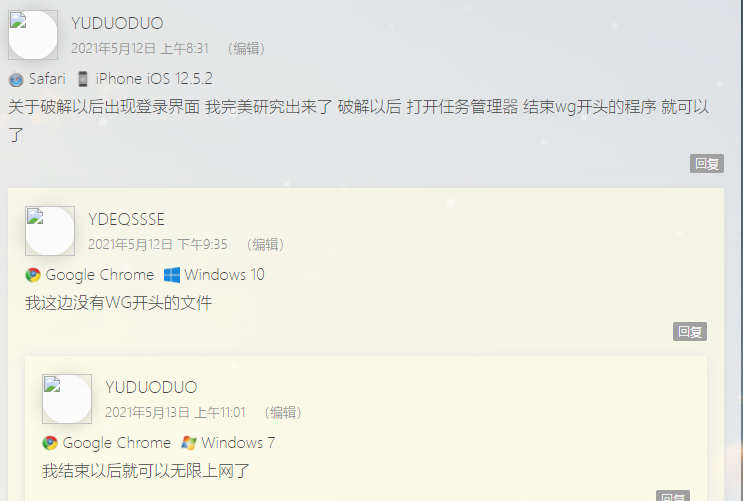

4.评论区有人研究到一个程序可以防止弹出登录界面

因为大家的网吧都是遍布全国各地,防逃费程序都不一样,所以我没有办法更新到每个人,大家可以自己试着自己解决一些问题。评论区有个兄弟说打开任务管理器 结束wg开头的程序 就可以解决弹出登录界面了。大家自测。而有的兄弟就没有这个进程,这就是根据地区原因,防逃费进程都不一样。所以真的需要大家自己动起手来了,白嫖的可能性没有那么大了。你们研究出各个地区的防逃费,我就会把代码加到程序里,尽量做到通杀,谢谢。

以上问题请自行解决,因为我所在的地区是测试完成可以使用的,但是我无法做到全国通用,抱歉,但是你们自己去操作的时候,有什么不懂的解决不了的问题,可以留言,我可以帮助你们解决问题。

下载地址

抱歉,只有登录并在本文发表评论才能阅读隐藏内容

Google Chrome

Google Chrome  Windows 10

Windows 10